Page 17 - ELG2404 April Issue 489

P. 17

SPECIAL SUPPLEMENT

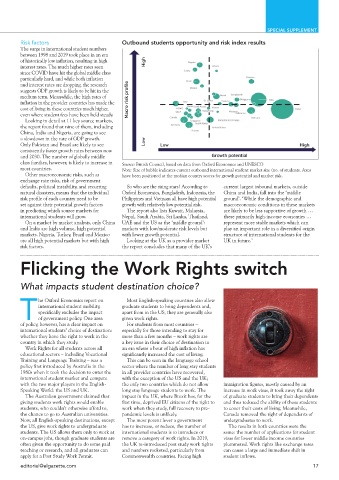

Risk factors Outbound students opportunity and risk index results

The surge in international student numbers

between 1998 and 2019 took place in an era

of historically low inflation, resulting in high

interest rates. The much higher rates seen

since COVID have hit the global middle class

particularly hard, and while both inflation

and interest rates are dropping, the research

suggests GDP growth is likely to be hit in the

medium term. Meanwhile, the high rates of

inflation in the provider countries has made the

cost of living in these countries much higher,

even where student fees have been held steady.

Looking in detail at 11 key source markets,

the report found that nine of them, including

China, India and Nigeria, are going to see

a slowdown in the rate of GDP growth.

Only Pakistan and Brazil are likely to see

consistently faster growth rates between now

and 2030. The number of globally middle

class families, however, is likely to increase in Source: British Council, based on data from Oxford Economics and UNESCO

most countries. Note: Size of bubble indicates current outbound international student market size (no. of students. Axes

Other macroeconomic risks, such as have been positioned at the median country scores for growth potential and market risk.

exchange rate risks, risk of government

defaults, political instability, and recurring So who are the rising stars? According to current largest inbound markets, outside

natural disasters, means that the individual Oxford Economics, Bangladesh, Indonesia, the China and India, fall into the ‘middle

risk profile of each country need to be Philippines and Vietnam all have high potential ground’. ‘While the demographic and

set against their potential growth factors growth with relatively low potential risk. macroeconomic conditions in these markets

in predicting which source markets for The report also lists Kuwait, Malaysia, are likely to be less supportive of growth …

international students will grow. Nepal, Saudi Arabia, Sri Lanka, Thailand, these primarily high-income economies …

On a market by market analysis, only China UAE and the US as the ‘middle ground’: represent more stable markets which can

and India are high volume, high potential markets with low/moderate risk levels but play an important role in a diversified origin

markets. Nigeria, Turkey, Brazil and Mexico with lower growth potential. structure of international students for the

are all high potential markets but with high Looking at the UK as a provider market UK in future.’

risk factors. the report concludes that many of the UK’s

Flicking the Work Rights switch

Flicking the W ork Rights switch

What impacts student destination choice?

he Oxford Economics report on Most English-speaking countries also allow

international student mobility, graduate students to bring dependents and,

specifically excludes the impact apart from in the US, they are generally also

Tof government policy. One area given work rights.

of policy, however, has a clear impact on For students from most countries –

international students’ choice of destination: especially for those intending to stay for

whether they have the right to work in the more than a few months – work rights are

country in which they study. a key issue in their choice of destination in

Work Rights for all students across all an era where a bout of high inflation has

educational sectors – including Vocational significantly increased the cost of living.

Training and Language Training – was a This can be seen in the language school

policy first introduced by Australia in the sector where the number of long stay students

1980s when it took the decision to enter the in all provider countries have recovered,

international student market and compete with the exception of the US and the UK;

with the two major players in the English- the only two countries which do not allow immigration figures, mostly caused by an

Speaking World: the US and UK. long stay language students to work. The increase in work visas, it took away the right

The Australian government claimed that impact in the UK, where Brexit has, for the of graduate students to bring their dependents

giving students work rights would enable first time, deprived EU citizens of the right to and thus reduced the ability of those students

students, who couldn’t otherwise afford to, work when they study, full recovery to pre- to cover their costs of living. Meanwhile,

the chance to go to Australian universities. pandemic levels is unlikely. Canada removed the right of dependents of

Now, all English-speaking destinations, except The most potent lever a government undergraduates to work.

the US, give work rights to undergraduate has to increase, or reduce, the number of The results in both countries were the

students. The US allows them only to work at international students is to introduce or same: the number of applications for student

on-campus jobs, though graduate students are remove a category of work rights. In 2019, visas for lower middle income countries

often given the opportunity to do some paid the UK re-introduced post study work rights plummeted. Work rights like exchange rates

teaching or research, and all graduates can and numbers rocketed, particularly from can cause a large and immediate shift in

apply for a Post Study Work Permit. Commonwealth countries. Facing high student inflows.

editorial@elgazette.com 17