Predicting the future of the foreign student market…

Predicting the future of markets has often been a mug’s game. So, when a recent British Council press release suggested that growth in the number of international students heading abroad for university would slow over the next decade, we wondered if this could possibly be true.

According to the British Council: ‘The most significant slowdown in growth rate terms is anticipated in China, with noteworthy slowdowns also expected in other key outbound markets including India, Vietnam, Nigeria and Indonesia. Only Brazil and Pakistan are projected to see an increase in the pace of growth in the 2019-30 period.’

How could they possibly know?

Because, as the researchers from Oxford Economics found, the historic growth in the flows of students since 1998 is highly correlated to the growth in GDP.

In the 30 markets which Oxford Economics examined, GDP growth in any individual country was closely correlated with the number of its students who go abroad. Countries which have seen the fastest economic growth, such as China, India and Vietnam have seen matching growth in the outbound student number while countries with slower economic growth such as Japan, Spain and Canada have seen low growth in their outbound student markets.

However GDP growth alone does not explain everything.

Since 1998, when UNESCO started to record global figures, the number of students studying at universities overseas has grown, on average, by 5.4% a year, while GDP has grown, by 3.5%. Simply focusing on GDP leads to an over-emphasis on advanced economies like the US and Germany, where there is sufficient provision of excellent universities and, at least in Germany, a falling number of citizens of university age.

US students, for example, make up just 1.7% of those going abroad to study while the US economy accounts for 25% of global GDP. By contrast, India makes up just 3.1% of the global economy but provides 8.1% of all international students.

Demographics are, of course, a key factor; countries with huge populations and high birthrates, like India, may have a relatively low GDP, meaning that only a small percentage of the population are rich enough to consider sending their children to university overseas. However just 1% of a population nearing 1.5 billion still gives you a market of 15 million.

Besides demographics, two other macroeconomic factors also need to be taken into account…

Macroeconomic indicators

The first key macroeconomic indicator of potential growth in the size of a source market is a growth in household income; more specifically, growth in the number of families with incomes equivalent to the global middle class. Real GDP growth combined with an increase in the middle and higher income families, is one key indicator of the potential for an increase in the number of students going abroad.

This is true even where population growth is declining. In China, birth rates are plummeting, but going forward, growth in family incomes will continue. By 2030, 66 million more Chinese families will join the global middle class. By contrast, only another eight million US families and just four million Indonesian families are likely to do so.

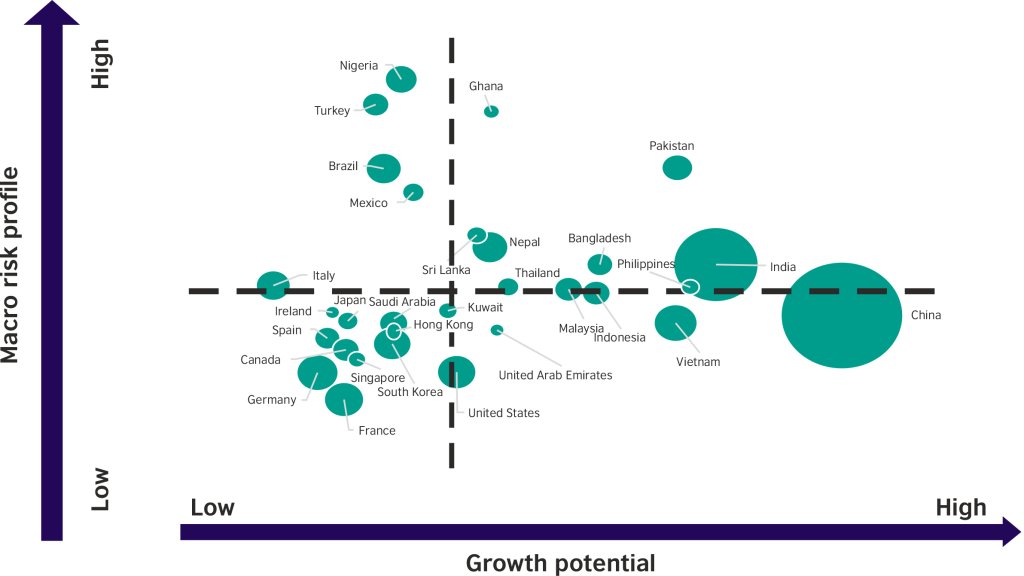

Outbound students opportunity and risk index results

Note: Size of bubble indicates current outbound international student market size (no. of students. Axes

have been positioned at the median country scores for growth potential and market risk.

The second key macroeconomic factor is exchange rates. This is not news; we have long known that a higher exchange rate in one country, such as the US, will push students into applying for courses in another one, historically Canada, instead.

However, what if the currency of a particular source country falls against those of all the provider countries? Oxford Economics has been able to weigh the currency exchange rate of each of the 30 markets against a basket of currencies covering all the provider countries. Their analysis shows that exchange rates play a vital role, particularly in price-sensitive countries like Nigeria and Nepal. Indeed, they suggest that although ‘GDP and household incomes are more useful as medium-term predictors, exchange rates have more immediate impacts’.

Risk factors

The surge in international student numbers between 1998 and 2019 took place in an era of historically low inflation, resulting in high interest rates. The much higher rates seen since COVID have hit the global middle class particularly hard, and while both inflation and interest rates are dropping, the research suggests GDP growth is likely to be hit in the medium term. Meanwhile, the high rates of inflation in the provider countries has made the cost of living in these countries much higher, even where student fees have been held steady.

Looking in detail at 11 key source markets, the report found that nine of them, including China, India and Nigeria, are going to see a slowdown in the rate of GDP growth. Only Pakistan and Brazil are likely to see consistently faster growth rates between now and 2030. The number of globally middle class families, however, is likely to increase in most countries.

Other macroeconomic risks, such as exchange rate risks, risk of government defaults, political instability, and recurring natural disasters, means that the individual risk profile of each country need to be set against their potential growth factors in predicting which source markets for international students will grow.

On a market by market analysis, only China and India are high volume, high potential markets. Nigeria, Turkey, Brazil and Mexico are all high potential markets but with high risk factors.

So who are the rising stars? According to Oxford Economics, Bangladesh, Indonesia, the Philippines and Vietnam all have high potential growth with relatively low potential risk.

The report also lists Kuwait, Malaysia, Nepal, Saudi Arabia, Sri Lanka, Thailand, UAE and the US as the ‘middle ground’: markets with low/moderate risk levels but with lower growth potential.

Looking at the UK as a provider market the report concludes that many of the UK’s current largest inbound markets, outside China and India, fall into the ‘middle ground’. ‘While the demographic and macroeconomic conditions in these markets are likely to be less supportive of growth … these primarily high-income economies … represent more stable markets which can play an important role in a diversified origin structure of international students for the UK in future.’