Patrik Pavlacic, Chief Researcher at market analysts Bonard, reveals the 2018 student statistics

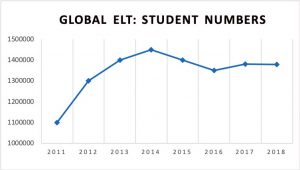

After its peak in 2014, confirmation comes that the global English language travel sector has entered maturity. From a destination perspective, the times of double-digit year-on-year increases are long gone and the international arena effectively constitutes a zero-sum game – destinations are growing at each other’s expense.

As an independent market research specialist, at Bonard we align global data collection and reporting for eight traditional English Language destinations: Australia, Canada, Ireland, Malta, New Zealand, South Africa, the UK and the USA.

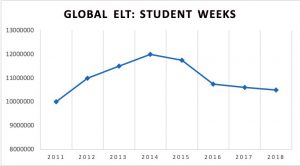

We estimate that in 2018 there were approximately 1.38 million international students pursuing English language courses abroad for a total of 10,496,000 student weeks, the traditional measurement of length of stay. The figures mark a 0.5 per cent decrease in terms of student numbers and a decrease of 3.2 per cent in terms of student weeks compared to 2017.

Gradual declines in the average length of stay in destinations such as the UK, the USA, Australia and Canada have contributed to the fall in the number of overall student weeks. The only exceptions to this trend in 2018 were Ireland and South Africa, which, despite decreases in student numbers, posted growth in student weeks.

According to the work we have done with English UK, Britain experienced mixed development in 2018 – even though student numbers rose by 1.6 per cent, student weeks dipped by 0.9 per cent.

The maturity of the sector is also demonstrated by the performance of the top 20 source countries. They produce 84 per cent of all student weeks globally, yet only eight markets within this club grew year-on-year.

We saw China and Japan, the leading source markets in Asia, decline in 2018: China dropped by 7 per cent, the first time decrease since 2012. However, the picture is also skewed by the emergence of the Philippines as an increasingly sought-after ELT destination within the region.

In addition, while traditionally strong Western European markets continue to shrink, there are considerable opportunities in Latin America. Colombia, Brazil and Mexico all performed well last year, experiencing a year-on-year increase in student weeks of 11 per cent, 3 per cent and 14 per cent respectively.

What are the driving forces behind these developments? There are a number of macro trends.

First, the growth in the number of English learners around the world is slowing. The British Council reckons that English is already spoken at a useful level by some 1.75 billion people, a quarter of the world’s population.

Second, domestic education systems are developing and the local supply of English language providers as well as online learning have been on the increase, offering learners the opportunity to study English locally and thus meeting demand, especially for those at lower levels of proficiency.

Next comes the rise of non-traditional destinations such as the Philippines and Malaysia, which attract a significant proportion of intra-regional English language student mobility from within Asia. At Bonard, our ongoing investigation into the Philippines’ market has counted over 100 language centres catering to international students.

“The British Council reckons that English is already spoken at a useful level by some 1.75 billion people, a quarter of the world’s population.”

Demographics and purpose of learning are also shifting. Destinations such as the UK, Ireland and Malta have experienced increases in the numbers of juniors, who now account for more than half of all English language students from abroad. This is coupled with the fact that General English has been on the decrease. There is greater demand for more advanced/experience-based courses, such as English for Academic Purposes, English courses leading to better career opportunities, English-plus-Activity courses and so forth.

Finally, we are seeing consolidation. Providers and agents are increasingly evaluating where growth opportunities lie and where to invest, but are also becoming more aware of the need to identify internal efficiencies. Over the last 12 months, we have observed that the sector is attracting external capital, and Mergers and Acquisitions and school-agency partnerships are increasing, but the sector is also experiencing closures.

The UK still attracts the largest number of English language learners (just above 580,000). Its new International Education Strategy aims to increase the value of education exports to £35 billion per year and the number of higher education students hosted in the UK to 600,000 per year by 2030. The UK government has recently reinstated the two-year work visa for international graduates from British universities.

With these initiatives, the government is trying to boost the image of the UK in times of uncertainty surrounding Brexit. Also, the current political and economic situation in the UK is keeping the currency exchange rates low, capturing interest among potential students.

The UK has the potential to perform well in upcoming years and attract an increased number of language students. However, the omnipresent trend of shorter course duration may keep the student weeks figure flat or subject to minor fluctuations.