Bonard’s Grace Zhu unpacks the emerging trends

The global health crisis had a major impact on most industries and sectors, and the education sector in China was no exception. Given the recent major developments in the country, including new regulations affecting the after-school tuition sector, the whole market needs to adjust its strategy.

According to data on global flows of students in English language travel (ELT) provided by Bonard, a global specialist for the international education sector, China held onto its position as the biggest source market globally. Across the eight traditional ELT destinations (the UK, USA, Australia, Canada, Ireland, Malta, New Zealand and South Africa), it accounted for 1,597,268 student weeks in 2019. This translates into 16% of all student weeks generated in the global ELT industry pre-pandemic. Due to the pandemic, the figures dropped by 51% between 2019 and 2020, which was slightly lower than the overall ELT industry decline (56%).

In recent years, Bonard has noted emerging shifts in destination preferences among Chinese students. The three most popular English language study destinations are Australia (30% of all Chinese student weeks abroad), the USA (28%) and the UK (18%). However, while Australia and the USA experienced a decline, the UK managed to grow between 2017 and 2019. Similarly, Ireland and Malta also enjoyed growth from China between 2017 and 2019, which indicates that Chinese students may be developing a greater appetite for European destinations.

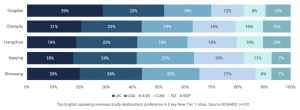

The current travel restrictions in Australia and New Zealand have brought about a change in student preferences, according to research recently carried out with agencies in China’s new Tier 1 cities. While the USA and UK still hold approximately 50% of the market, Australia now ranks third in terms of student preference, followed by Canada, New Zealand, Singapore and some European countries.

How do Chinese students choose an international programme?

Chinese students base their choices on the price, safety and geographical proximity of the destination countries. These factors are followed by the local accent or the destination country’s policies affecting international students. For these reasons, countries such as the Philippines, Malaysia and Singapore have gradually become more popular. These lower-cost destinations predominantly offer general English courses.

However, the two most popular types of programmes for Chinese students are language learning combined with short-term/summer- camp activities, and language training for exam preparation. The UK and USA remain the leading destinations for these programmes.

As Bonard’s data shows, these programmes are mainly promoted among the Chinese student cohort by study-abroad consultant agencies, rather than by schools directly. On Baidu, the largest search engine in China, agency promotions are quite frequent and significant. For example, when the keywords ‘US study abroad’ are typed into Baidu’s search bar, nearly 95% of the results are advertisements paid for by Chinese study- abroad agencies, with the rest being references to study-abroad forums or Q&A platforms.

This picture only confirms the importance of traditional agencies in China, as they are still relied upon heavily by most Chinese students and their parents when planning international studies. After students receive the relevant programme information through social media, most choose to further consult with agencies before making a decision.

Recent regulations on after-school training and their impact

On 21 May 2021, the Chinese government officially acted to further reduce students’ homework and after-school training during compulsory education.

The so-called ‘Double Relief Policy’ has two principal objectives: to reduce the homework burden of students in compulsory education and to reduce the burden of off-campus tutoring. Under the impact of these policies, many small and medium-sized tutoring institutions in the K to 12 education sector – and sometimes even the large ones – are facing a crisis.

After in-depth research, Bonard found that English, as one of the main education subjects, has also been affected. For example, the new high-school entrance examination in Liaoning Province has changed the original English score of 120 points to 100 points. Recently, Shanghai reformed the final primary-school examinations and English was not included (for more on this, see opposite page).

For this reason, students (and their parents) are gradually turning their attention to studying English abroad. As study abroad agencies told Bonard, they are, on the whole, optimistic about this trend as the policy may bring new opportunities for the industry. Most have not yet felt the influence of the new policy on the international education sector; however, they consider that there might be an increasing demand for programmes such as junior summer camps. Instead, the main concerns remain the duration and impact of the pandemic as well as political developments in the destination countries, as parents need to be reassured about the safety of their children, especially when it comes to junior students. Therefore, going into recovery, it is expected that Chinese students will be even more carefully evaluating their choice of destination.